Weekly Fixed Income Insights

Track what matters in fixed income: Macro news, policy moves and developments in the municipal and corporate markets.

Fixed Income Five: Put A Bow on 2025: A Very Good Year for Fixed Income

January 9, 2026

Fixed income portfolio manager Kevin Lynyak shares his insights into the current bond market. Listen now:

Fixed Income Five: The IEEPA Tariff Ruling & Bond Market Implications

January 9, 2026

Fixed income portfolio manager Kevin Lynyak shares his insights into the current bond market. Listen now:

January 13, 2026

Macro update

Street-consensus average forecast for the 10-year Treasury stands at 4.10% by the end of 2026 and 4.10% again by year-end 2027. Given the prevailing yield of 4.17%, such minimal moves could mask substantial interim volatility, as we saw during 2025 (Bloomberg, 1/09/26).

These conservative expectations reflect the Fed’s latest dot plot, which indicates a shallower path for further rate cuts. The Fed is currently signaling just one 25 basis point (bps) cut during calendar 2026 and another of the same magnitude in 2027. We expect bonds to continue to play larger roles in diversified portfolios this year (Bloomberg, 1/09/26).

We expect the US economy to hold up well in the coming year. However, it’s quite possible that bouts of volatility will reemerge. This is considering uncertain fiscal and policy paths, potential conflicting signals from a data-dependent Fed now weighing a 4.6% unemployment rate, inflation hovering at almost a point above the Fed’s 2% target, a deceleration in payroll growth and a strong 3Q25 GDP print of 4.3%, not to mention ongoing tariff uncertainty.

The market received its first on-time payroll situation report in months on January 9. The data revealed 50,000 jobs created versus expectations for 70,000, and an unemployment rate of 4.4% versus expectations for 4.5% and a prior reading of 4.6% (Bloomberg, 1/09/26).

Geopolitical headlines continue to roll in in the new year, but flight to quality gains in USTs thus far have been minimal (Bloomberg, 1/09/2026).

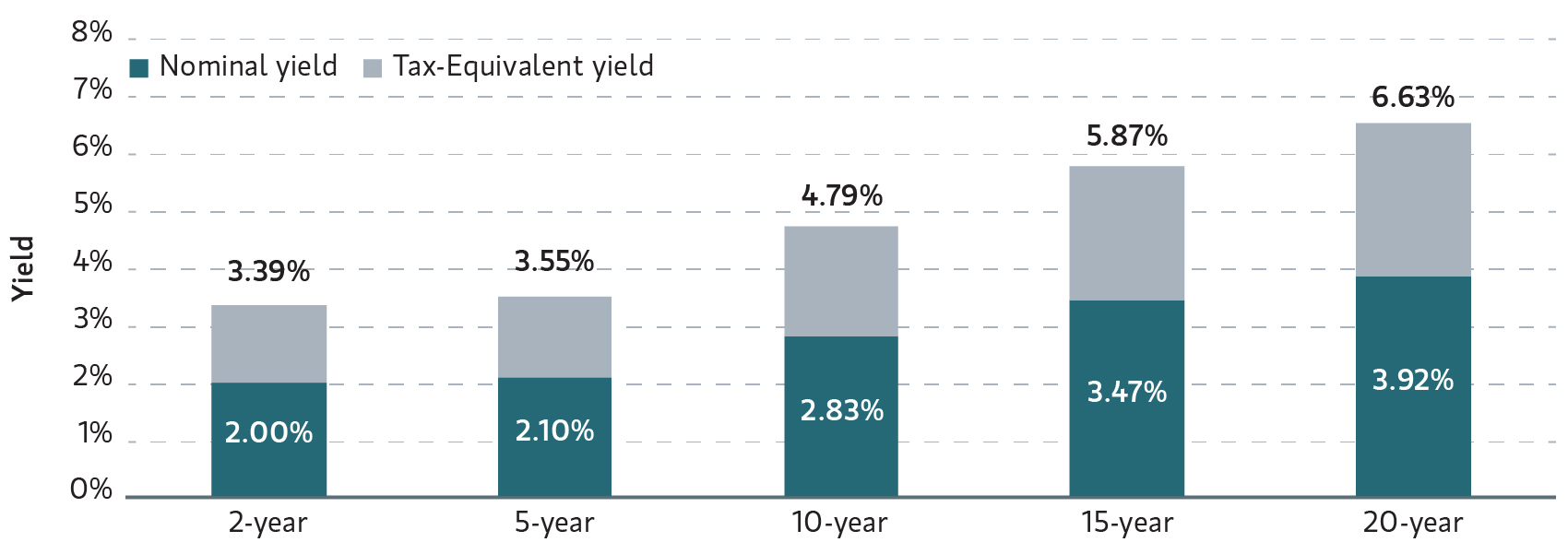

Municipal bond update

AAA municipal yields rallied materially during the first full week of 2026 trading. Two-year yields dipped by 12 bps, while five-, 10- and 30-year yields declined by 13, 11 and four bps, respectively. This price action left these benchmark yields at 2.27%, 2.27%, 2.67% and 4.21%, respectively (LSEG MMD, 1/09/2026).

Five- to 30-year A-rated municipal yields closed the first full week of 2026 ranging from 2.35% to 4.57%, with related taxable-equivalent yields ranging from 3.97% to 7.72%, assuming a combined federal tax rate of 40.8% (LSEG MMD, Parametric, 1/09/2026).

Muni mutual funds saw net inflows last week of $10.5 billion, with ETFs attracting $800 million and open-end funds bringing in $654 million (JPMorgan, 1/07/2026).

Tax-exempts sharply outperformed Treasurys last week, with the Bloomberg Municipal Bond Index increasing 0.68%, compared with a 0.20% gain for the Bloomberg US Treasury Index (Bloomberg, 1/09/2026).

These gains were facilitated by two weeks of zero calendars during the holidays and a modest slate of $5 billion last week. This week shows the primary market is back in full force, with $10.5 billion in new issues scheduled to enter the market (Ipreo, 1/09/2026).

Municipal Index Yield to Worst

Sources: LSEG, Parametric, 1/13/2026. For illustrative purposes only. It is not possible to invest directly in an index. Past performance is no guarantee of future results.

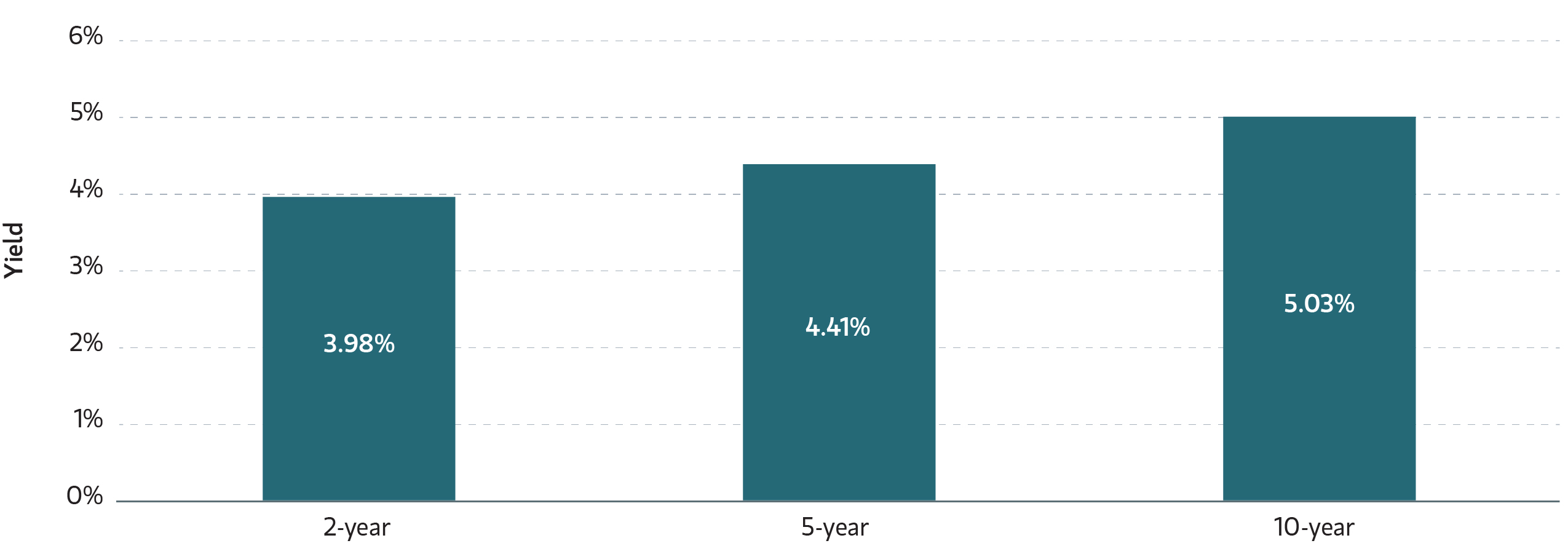

Corporate bond update

US investment-grade (IG) corporate yields were mixed across the curve last week. Two- and five-year yields increased three and one bps, respectively, while 10-year yields decreased three bps (Bloomberg, 1/9/2026).

The ICE BofA 1–10 Year US Corporate Index returned 0.11% for the week and month to date (MTD). The index outperformed like-duration Treasurys by 0.07% for the week and MTD (Bloomberg, 1/9/2026).

IG mutual funds and ETFs experienced inflows of $6.9 billion, an increase from the previous week’s inflows of $4.5 billion. Corporate-only funds experienced inflows of $1.4 billion, following the previous week’s inflows of $394 million (JPMorgan, 1/9/2026).

Corporate one- to 10-year IG bond yields ended last week at 4.5% (Bloomberg, 1/9/2026).

Corporate Index Yield to Worst

Source: Bloomberg as of 1/13/2026. Past performance is no guarantee of future results. The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment.

Investing in fixed income securities involves risk. All investments are subject to loss. Learn more.

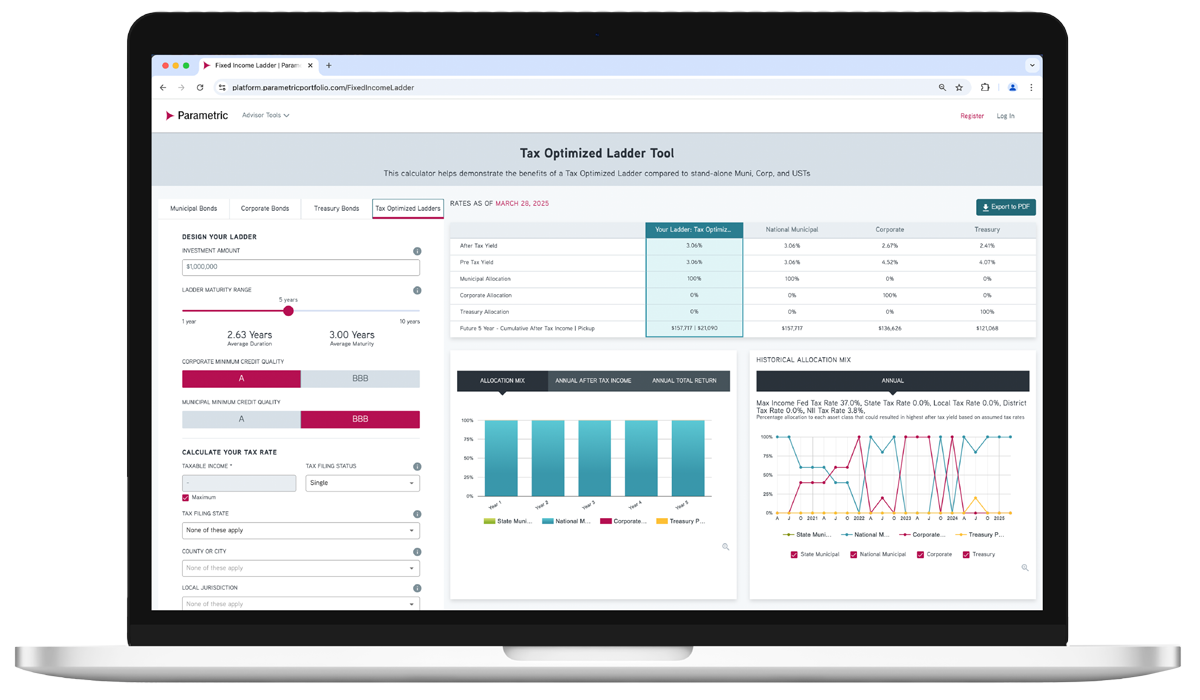

ADVISOR TOOL

Laddered Interest Rate Scenario Tool

Which fixed income asset class is just right for each investor? Explore possible ways to achieve optimal after-tax yield.

Use our online tool to showcase potential benefits of tax-managed and customized laddered bond portfolios.

Featured Content

Corporate Bond Market Insight - 2025 Year in Review

Review the US corporate fixed income market and see what’s ahead for investment-grade and high-yield bonds.

Municipal Bond Market Insight - Reasons to be Cheerful

Look back at the month in munis and find out what may be coming for taxable and tax-exempt bonds.

Preferred Securities Market Insight - “Cockroaches” Show Up in the Credit Market’s Darkest Corners

Find out how preferred securities performed this month and where we’re seeing potential for the next month.

Related Content

9/3/2025

8/27/2025

Explore all fixed income solutions

Get in touch

Discover how our fixed income solutions can address today’s challenges. Request a sample portfolio or transition analysis.